RMI Contributors: Ken Robbins & Tyler Wilson

Not all customers are created equal. While some are one-time buyers or perpetual bargain hunters, others are loyal repeat customers who love your products and spend consistently. Recognizing and nurturing high-value customers can be transformative for a business. But how can you identify these valuable customers? One effective approach is through RFM analysis, a powerful tool that helps segment your customer base for targeted marketing.

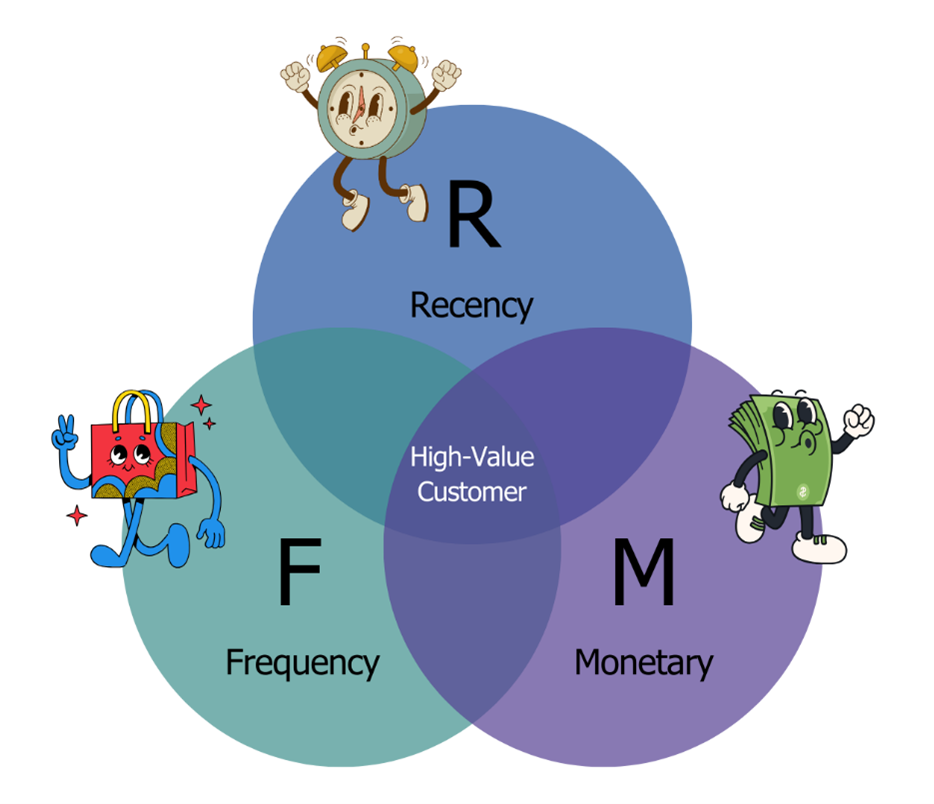

What is RFM Analysis?

RFM stands for recency, frequency, and monetary value—three key metrics that define customer behavior. By analyzing how recently a customer made a purchase (recency), how often they make purchases (frequency), and how much they spend (monetary value), you can segment them into different groups. These groups can then be targeted with customized marketing strategies.

- Recency: When did the customer last buy something? Those who recently made purchases are more likely to buy again.

- Frequency: How often do they buy? Regular buyers are typically more engaged and valuable.

- Monetary Value: How much do they spend? Customers who spend more contribute significantly to revenue and often show higher loyalty.

Each customer is scored based on these three metrics, resulting in a three-digit RFM score. For example, a customer with a high recency, frequency, and monetary score (e.g., 555) is highly engaged, makes lots of purchases, and has strong purchasing power, making them an ideal target for marketing campaigns, loyalty programs, and personalized offers. This scoring helps marketers identify the top spenders and those who make frequent purchases, offering opportunities for retention, cross-selling, and upsell efforts.

High-Value vs. Low-Value Customers

Once your customers are segmented, it’s important to distinguish between those who are high-value and those who are low-value. High-value customers—those with high RFM scores—typically see more meaning in your product or service. These customers are often your brand advocates and will likely spend more in the long run. In fact, it’s not uncommon for just 10% of customers to drive 30% of all sales. Treating this top segment like VIPs can help build loyalty, leading to sustained growth.

On the other hand, low-value customers might only buy during sales or complain more often than others. While they may still contribute to revenue, their inconsistent spending and engagement patterns suggest that they require a different strategy—one that doesn’t involve substantial marketing investments.

Leveraging RFM Analysis on Meta and Google

Platforms like Meta (Facebook) and Google have advertising algorithms that can use RFM data to target high-value prospects. Here’s how you can use RFM to improve your marketing efforts on these platforms:

- Upload High-Value Lists for Lookalike Campaigns: With RFM, you can create a list of high-value customers and load it into Meta or Google Ads to generate lookalike audiences. These algorithms can then find users with similar behaviors and interests, increasing your reach to other potential high-value customers. In one case, a business saw a more than 50% lift in response rates from Meta the day after it started targeting lookalike audiences based on high-value customers.

- Suppress Low-Value Customer Lookalikes: RFM analysis can also help you identify low-value customers so you can eliminate their lookalikes from your campaigns. Doing this helps prevent wasted ad spend on low-potential audiences. This approach will free up your budget to focus on more profitable segments.

Case Study: Conversion Lift through Lookalike Campaigns

For one client, we saw a 250% increase in conversion rates from a Meta lookalike campaign. We achieved these impressive results by targeting folks who matched the profile of the company’s high-value customers. High-value lookalikes often boost conversions and provide valuable insights into what resonates with them, which can inform future marketing campaigns.

How to Maximize Your High-Value Customer Relationships

To truly benefit from your high-value customers, it’s necessary to treat them differently—like gold members. These customers aren’t just frequent buyers; they find deeper, more meaningful value in your offerings. For instance, they may have an emotional connection to your brand or rely on your product to meet specific needs that other brands can’t fulfill.

To build and sustain relationships with high-value customers, consider implementing these strategies:

- Provide Exclusive Offers and Early Access: Reward high-value customers with exclusive discounts, early access to new products, and special events. Gestures like these reinforce their loyalty and make them feel valued.

- Personalize Their Communications: Use the data from your RFM analysis to customize their communications. For example, tailor their emails based on how often they make purchases or send them reminders based on their buying patterns.

- Ask for Their Feedback: Engage high-value customers by asking for their opinions. They can provide insights into how your products are used and what improvements might be beneficial.

- Run Loyalty Programs: Implement a loyalty program that recognizes high RFM scorers with points, perks, or rewards. Make sure these incentives are enticing enough to encourage their continued engagement.

Common Pitfalls and How to Avoid Them

While RFM analysis offers many benefits, there are a few pitfalls to be aware of:

- Overlooking Recency: Customers with high monetary value but low recency scores may seem valuable, but if they haven’t bought in a while, they might be at risk of churn. Make sure your retention strategies focus on re-engaging these customers to prevent them from slipping away.

- Ignoring Low-Value Segments Entirely: While focusing your marketing on high-value segments is wise, low-value segments can still be a source of incremental revenue. For example, you might try targeting these customers with lower-cost retargeting campaigns.

- Treating RFM as Static: Customer behavior changes, and RFM scores can fluctuate. Regularly update your analysis to keep up with changing customer preferences.

Master RFM Analysis to Achieve Long-Term Growth

RFM analysis is a simple yet effective method that helps businesses grow by identifying and focusing on the right customers. When brands segment their customers based on their recency, frequency, and monetary value, they can pinpoint those who are high-value and then seek to strengthen these relationships to drive repeat purchases. RFM analysis can offer a clear roadmap for building loyalty, boosting retention, and improving your targeting efforts on platforms like Meta and Google.

Ultimately, once marketers see that not all customers are the same, they can strategically invest in the relationships that will grow revenue. Maximize your marketing ROI, increase customer satisfaction, and achieve sustainable growth today by leveraging RFM data.